Managing your bills can be a daunting task, but with a bill planner printable, you can easily keep track of your expenses and due dates. By using a bill planner, you can avoid late payments, prevent missed due dates, and ultimately save money in late fees.

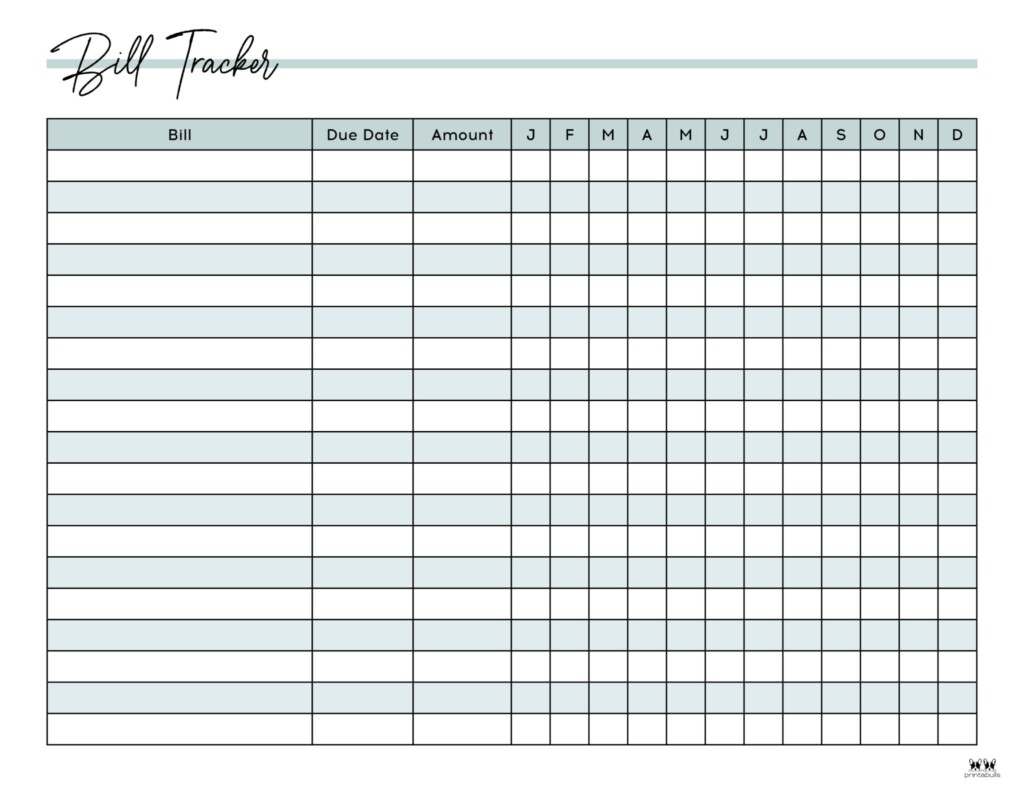

One of the main benefits of using a bill planner printable is that it allows you to see all your bills in one place. This can help you prioritize which bills need to be paid first and which can wait until your next paycheck. Additionally, a bill planner can help you budget your money more effectively by showing you how much you need to set aside for each bill.

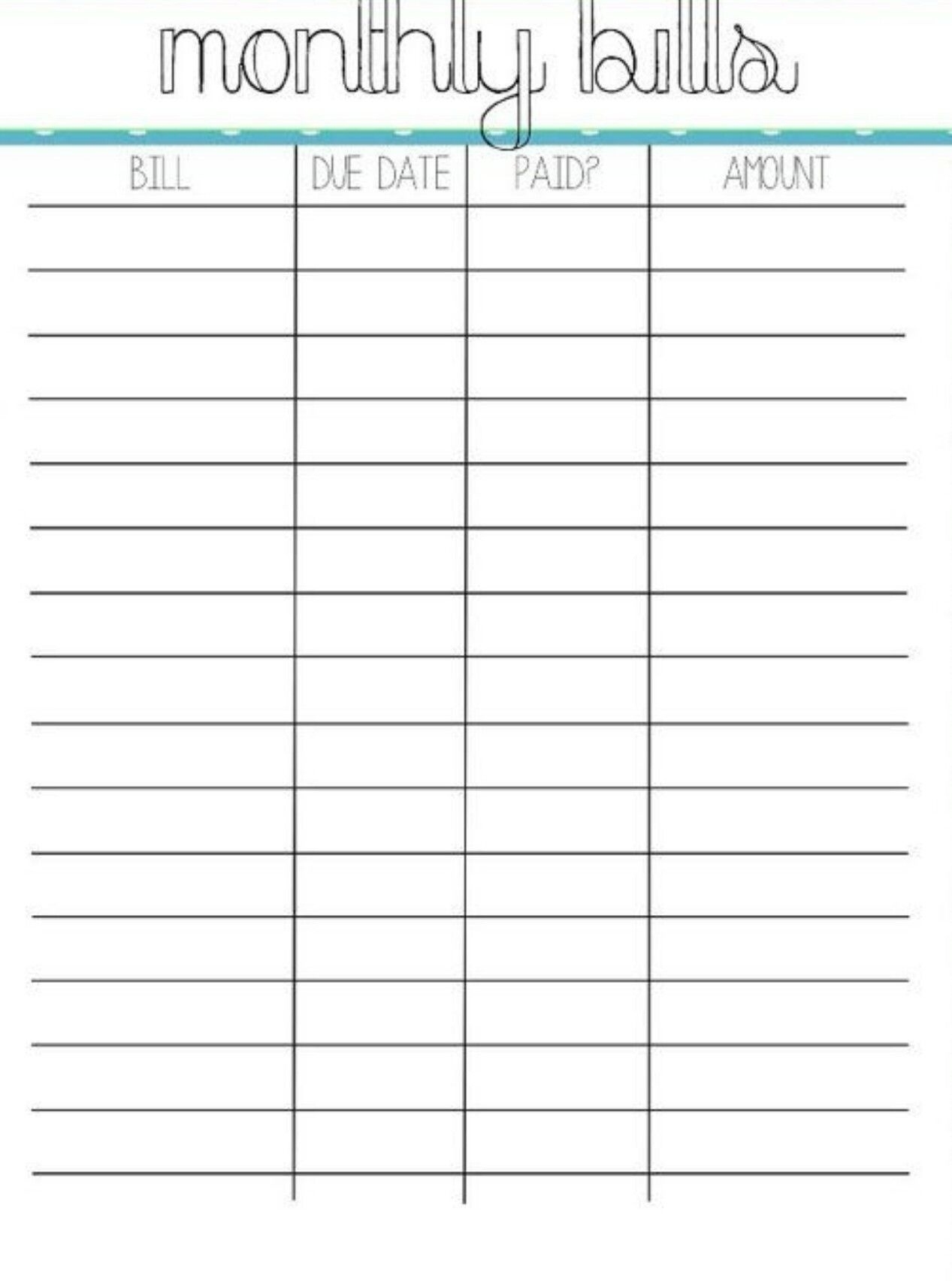

How to Use a Bill Planner Printable

Using a bill planner printable is simple. Start by listing all your bills, including the due date, amount due, and any other important information. Next, mark off each bill as you pay it to keep track of what has been paid and what still needs to be paid. You can also use the planner to set reminders for upcoming bills to ensure you never miss a payment.