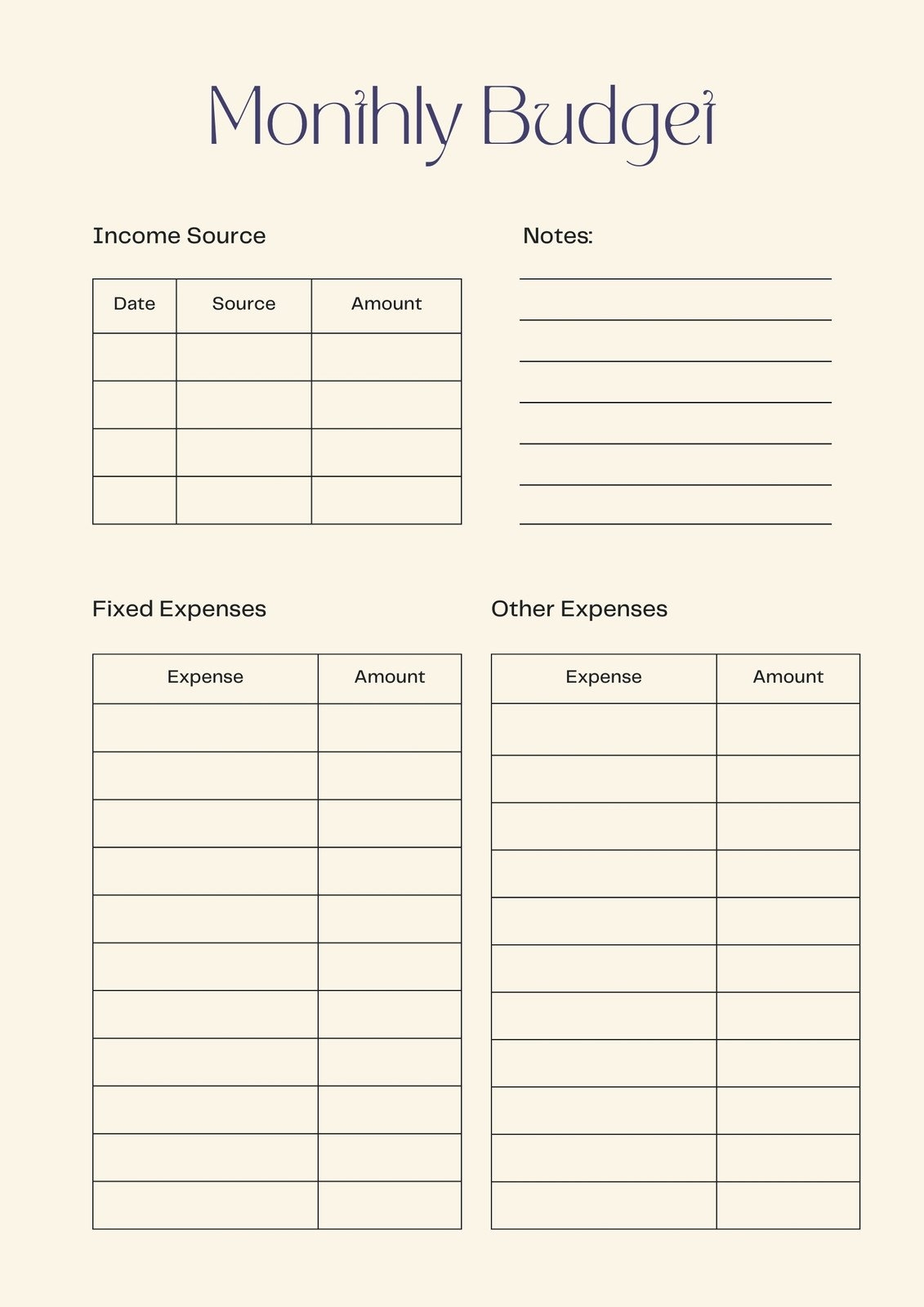

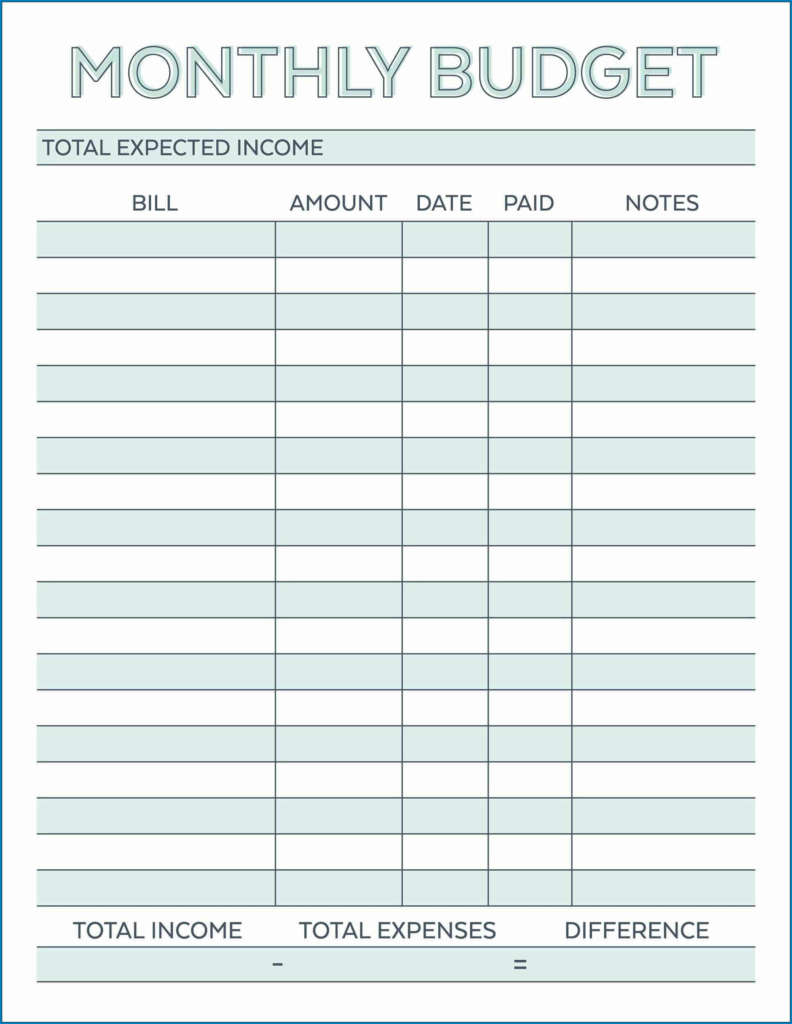

Managing your finances can be overwhelming, but having a budget planner can help you stay organized and on track with your financial goals. A basic budget planner printable is a simple and easy-to-use tool that can help you track your income, expenses, and savings. By using a budget planner, you can gain a better understanding of where your money is going and make informed decisions about your finances.

Using a basic budget planner printable is easy and straightforward. Start by listing all of your sources of income, including your salary, bonuses, and any other income you may have. Next, list all of your expenses, such as rent, utilities, groceries, and entertainment. Subtract your total expenses from your total income to determine how much money you have left over each month. This leftover amount can be put towards savings or paying off debt.

Tips for Using a Basic Budget Planner Printable

Here are some tips for effectively using a basic budget planner printable:

- Update your budget planner regularly to ensure accuracy

- Set realistic financial goals and track your progress

- Be flexible and adjust your budget as needed

- Use categories to organize your expenses and make it easier to track

- Review your budget regularly to identify areas where you can cut back on spending