Managing your finances can be a challenging task, especially when you get paid bi-weekly. Creating a bi-weekly budget planner can help you stay on track with your spending and savings goals. By having a clear plan in place, you can avoid overspending and ensure that you have enough money to cover your expenses until your next paycheck.

1. Organization: A bi-weekly budget planner allows you to see all of your income and expenses in one place. This can help you identify areas where you may be overspending and make adjustments accordingly.

2. Savings Goals: By setting specific savings goals in your budget planner, you can track your progress and stay motivated to reach your financial goals.

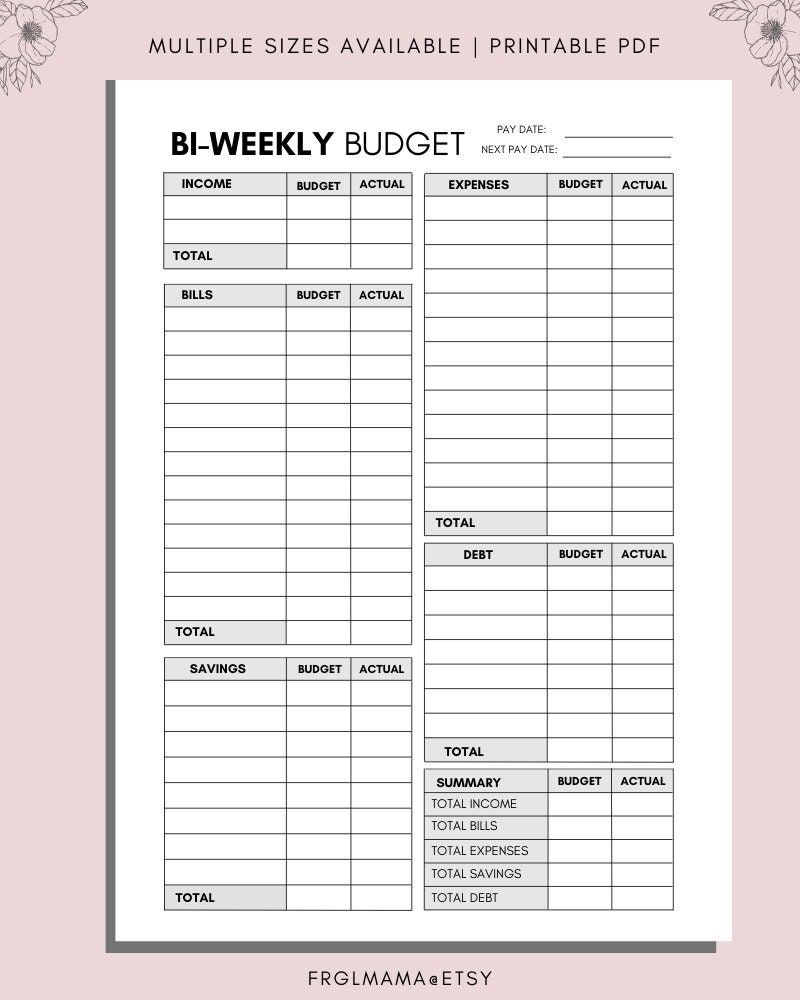

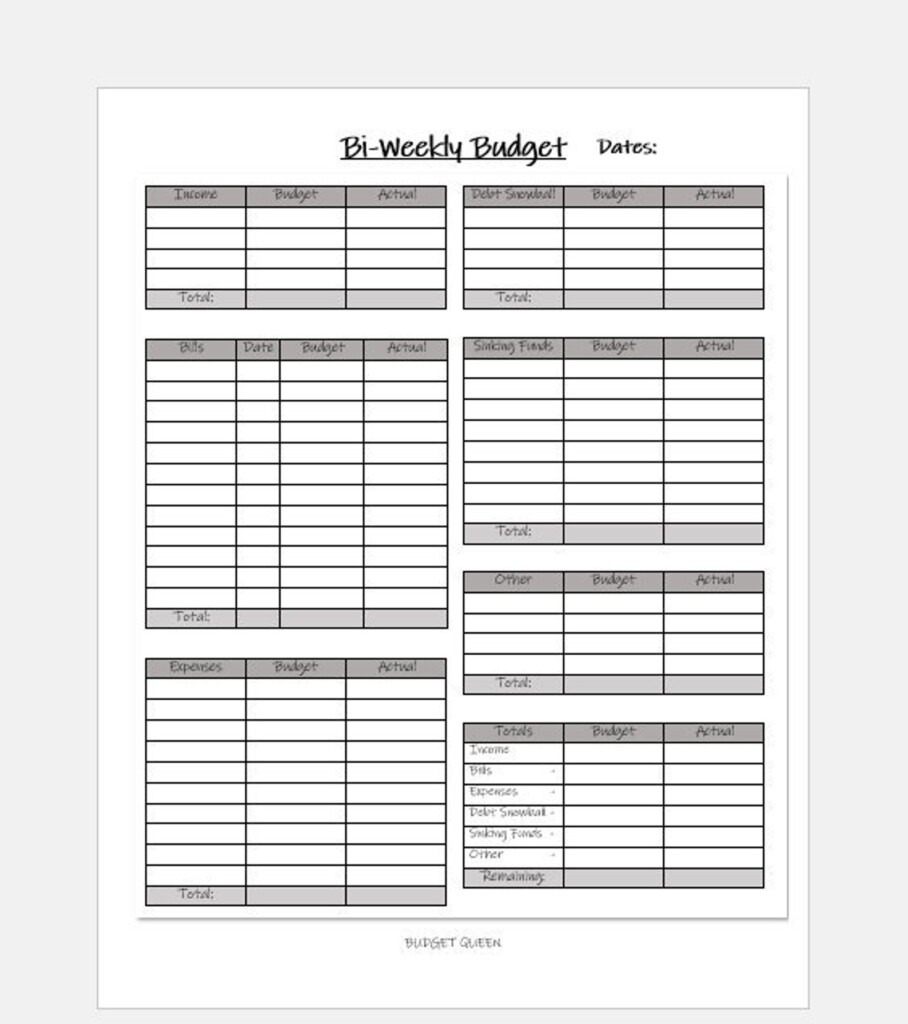

Free Printable Bi Weekly Budget Planner Templates

There are many free printable bi-weekly budget planner templates available online that you can download and use to create your own budget plan. These templates typically include sections for income, expenses, savings goals, and a summary of your budget for each pay period.

Some popular websites that offer free printable bi-weekly budget planner templates include Pinterest, Etsy, and Canva. You can customize these templates to fit your specific financial needs and preferences.