Staying on top of your bills and expenses can be a daunting task, but with the help of a bill budget planner printable, you can take control of your finances and ensure that you are meeting your financial goals. These printable planners are designed to help you track your bills, set a budget, and stay organized so that you can easily see where your money is going each month.

One of the main benefits of using a bill budget planner printable is that it allows you to see all of your bills and expenses in one place. This can help you identify any areas where you may be overspending or where you can cut back on expenses. By tracking your bills and setting a budget, you can also ensure that you are paying your bills on time and avoiding late fees.

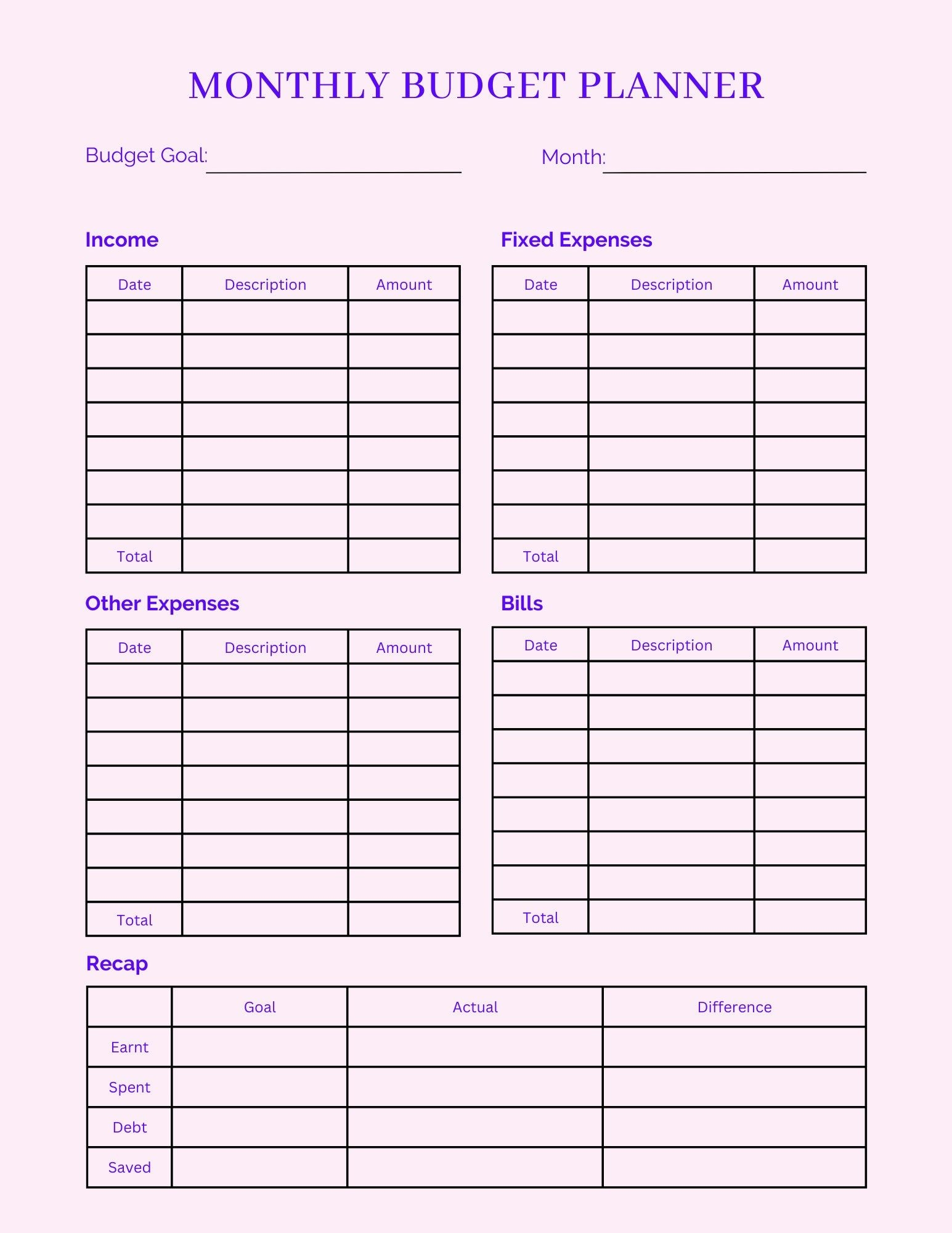

How to Use a Bill Budget Planner Printable

Using a bill budget planner printable is simple and straightforward. Start by listing all of your monthly bills and expenses, including rent or mortgage, utilities, groceries, and any other fixed expenses. Next, track your income and set a budget for each category. As the month progresses, update your planner with any new expenses or bills that come up. At the end of the month, review your planner to see how well you stuck to your budget and make any necessary adjustments for the following month.