A budget planner printable is a valuable tool that can help you track your expenses, set financial goals, and stay on top of your finances. By using a budget planner printable, you can easily see where your money is going each month and make adjustments as needed to ensure you are staying within your budget.

Having a budget planner printable can also help you save money, reduce debt, and achieve your financial goals faster. By tracking your expenses and income, you can identify areas where you can cut back on spending and redirect those funds towards savings or paying off debt.

How to Use a Budget Planner Printable

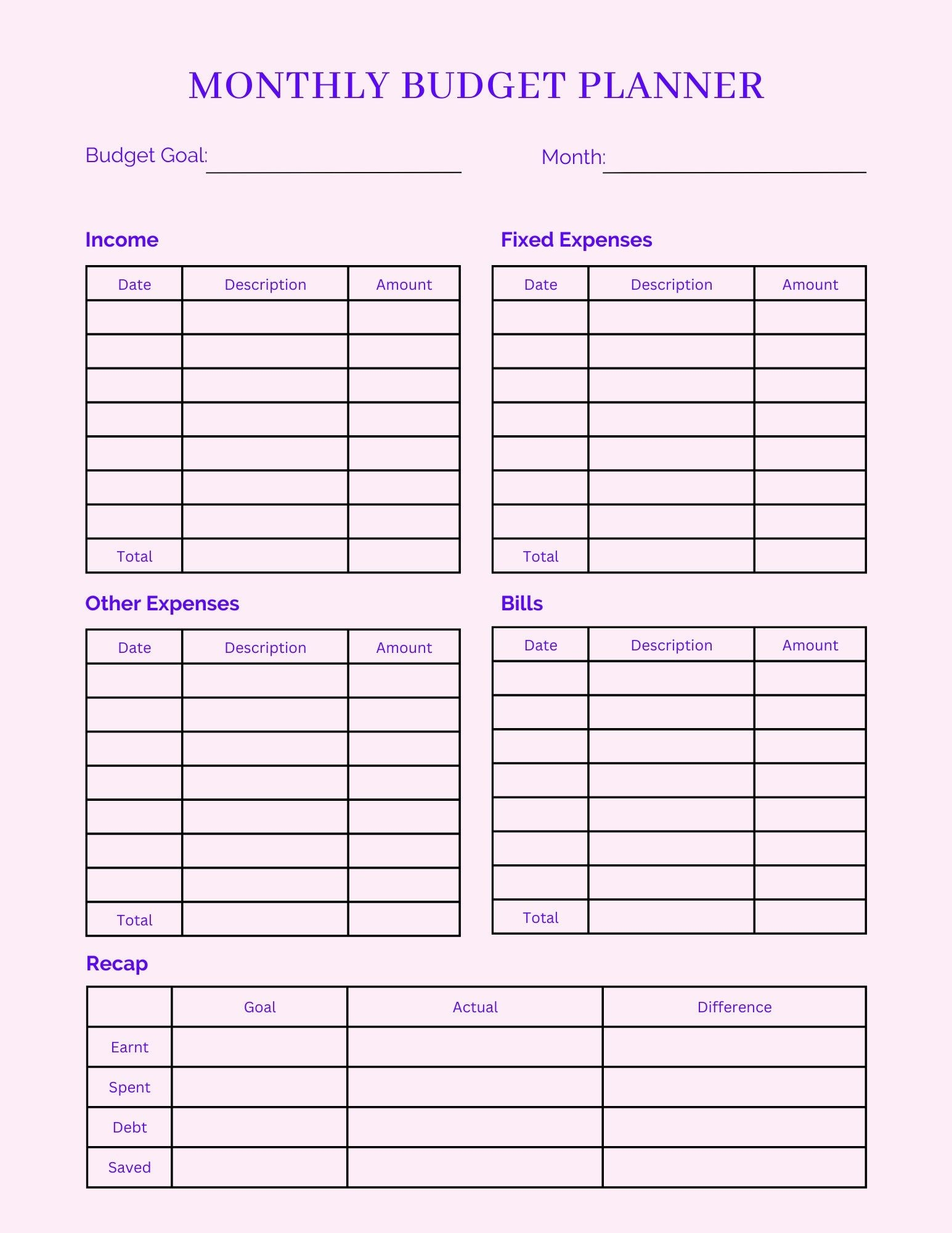

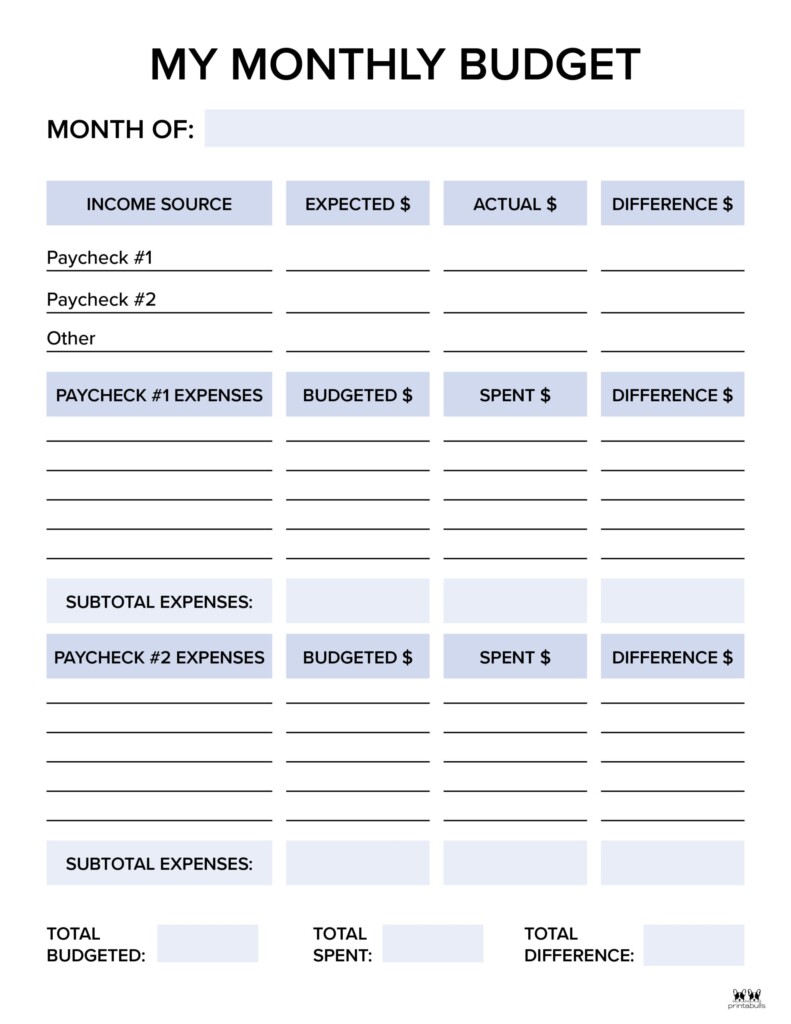

Using a budget planner printable is simple and can be customized to fit your individual financial situation. Start by listing all of your sources of income, including your salary, bonuses, and any other income you receive each month. Next, list all of your expenses, including rent or mortgage payments, utilities, groceries, and any other regular expenses you have.

Once you have listed all of your income and expenses, subtract your expenses from your income to see if you have a surplus or deficit. If you have a surplus, consider putting that extra money towards savings or paying off debt. If you have a deficit, look for areas where you can cut back on spending to bring your budget back into balance.

Benefits of Using a Budget Planner Printable

There are many benefits to using a budget planner printable, including:

- Helping you track your expenses and income

- Setting financial goals and tracking your progress

- Identifying areas where you can cut back on spending

- Increasing your savings and reducing debt

By using a budget planner printable, you can take control of your finances and work towards achieving your financial goals. Whether you are saving for a vacation, a new car, or retirement, a budget planner printable can help you stay on track and make informed financial decisions.