Creating a budget is essential for managing your finances effectively. A budget planner template printable can help you track your income and expenses, set financial goals, and prioritize your spending. By using a budget planner, you can identify areas where you may be overspending and make adjustments to ensure you are living within your means.

Having a budget in place can also help you save for future expenses, such as a vacation, home renovation, or emergency fund. It allows you to have a clear overview of your financial situation and plan for the future with confidence.

How to Use a Budget Planner Template Printable

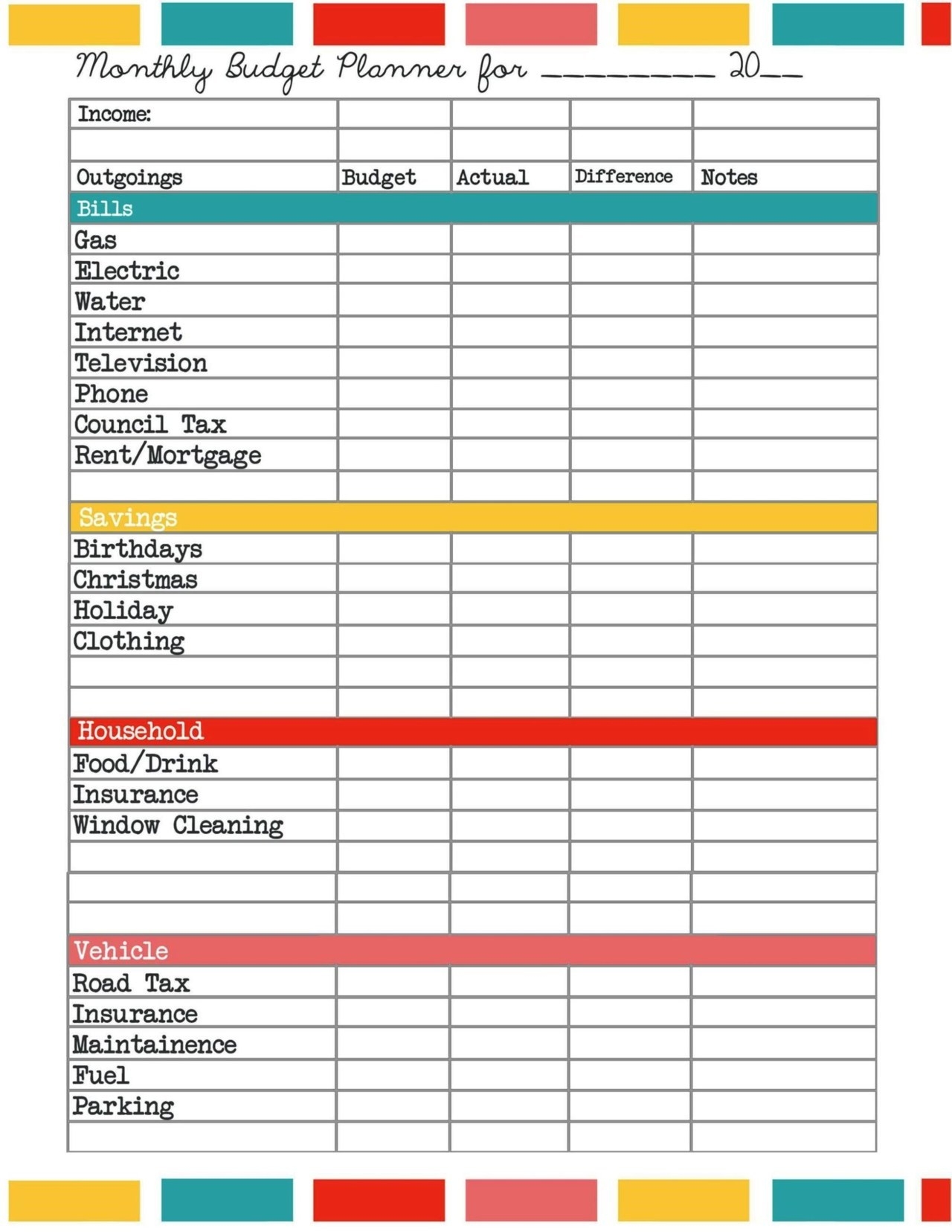

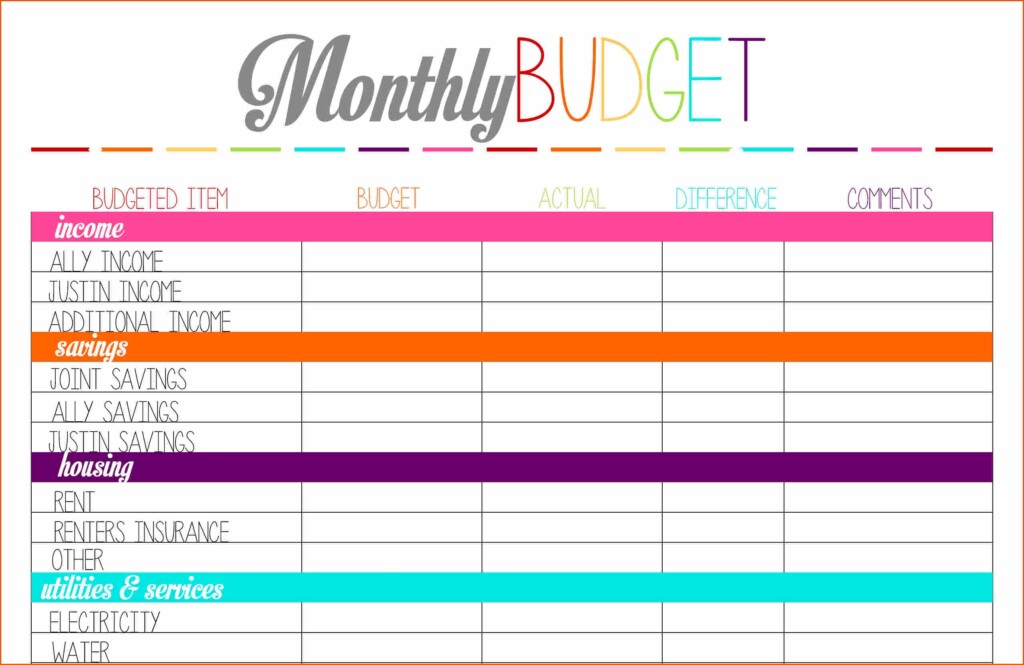

When using a budget planner template printable, start by listing all your sources of income, including your salary, side hustle, and any other additional income. Next, list all your monthly expenses, such as rent/mortgage, utilities, groceries, transportation, entertainment, and savings.

Once you have all your income and expenses listed, subtract your total expenses from your total income to determine if you have a surplus or a deficit. If you have a surplus, you can allocate the extra funds towards savings or paying off debt. If you have a deficit, you may need to adjust your spending or find ways to increase your income.

Benefits of Using a Budget Planner Template Printable

Using a budget planner template printable can help you stay organized and disciplined with your finances. It provides a visual representation of your financial situation, making it easier to track your progress towards your financial goals. Additionally, a budget planner can help you avoid impulse purchases and make more informed decisions about your spending.

By regularly updating your budget planner template, you can adapt to any changes in your income or expenses and ensure that you are staying on track with your financial goals. With a clear and structured budget in place, you can take control of your finances and work towards a more secure financial future.