A monthly budget planner is an essential tool for managing your finances effectively. By tracking your income and expenses on a monthly basis, you can gain better control over your money and make informed decisions about where to allocate your funds. With a budget planner, you can set financial goals, track your progress, and identify areas where you can cut back on spending.

Having a monthly budget planner can also help you avoid overspending, save for the future, and reduce financial stress. By creating a detailed budget plan, you can prioritize your expenses, identify any unnecessary spending, and make adjustments as needed to stay on track.

How to Use a Free Printable Monthly Budget Planner

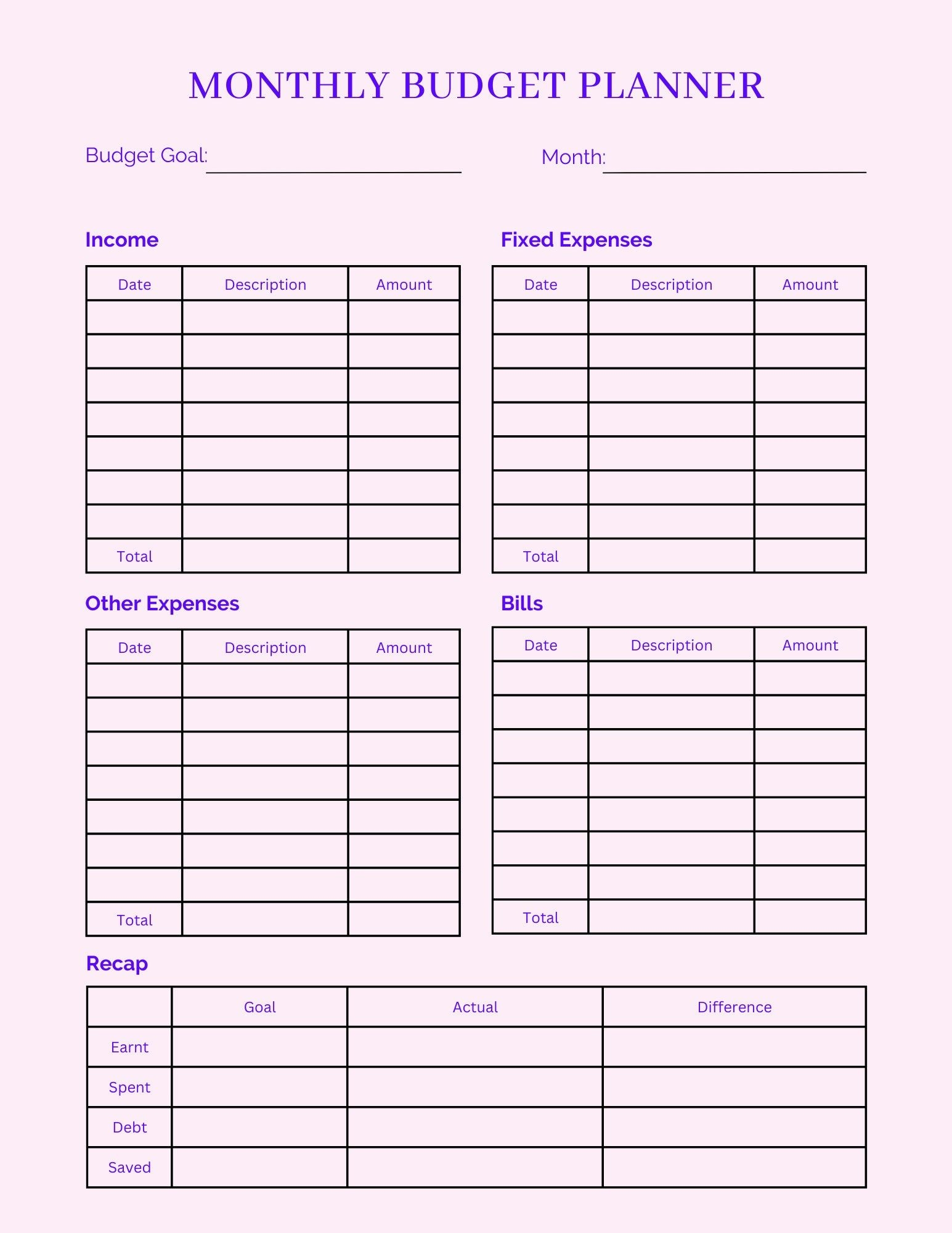

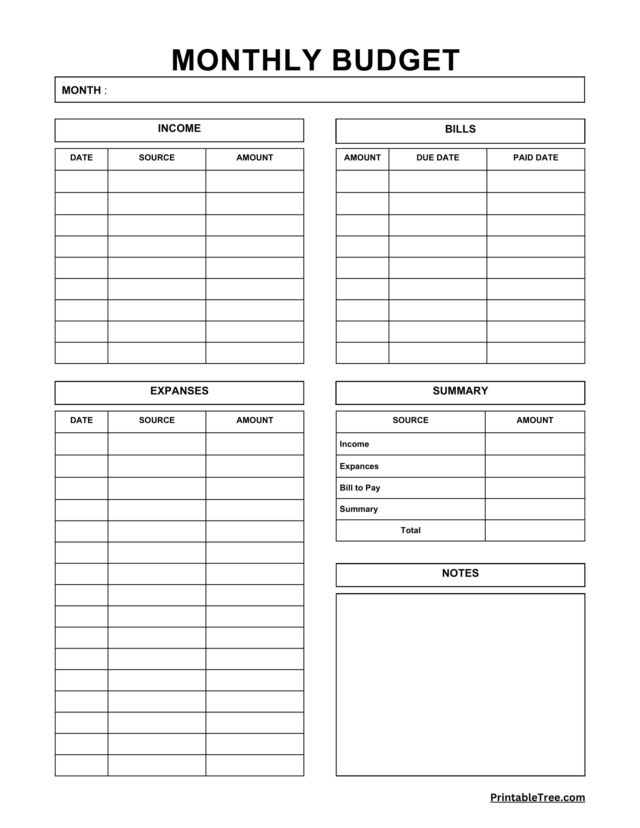

Using a free printable monthly budget planner is simple and convenient. You can easily find printable budget templates online that you can customize to suit your specific financial goals and needs. To get started, download a free printable budget planner template and fill in your income sources, expenses, and savings goals.

Once you have filled in all the necessary information, review your budget plan regularly to track your progress and make adjustments as needed. Be sure to update your budget planner each month with your actual income and expenses to ensure that you are staying on target with your financial goals.

Conclusion

A free printable monthly budget planner is a valuable tool for managing your finances and achieving your financial goals. By tracking your income and expenses, setting a budget, and regularly reviewing your financial plan, you can take control of your money and make smarter financial decisions. With a budget planner, you can avoid overspending, save for the future, and reduce financial stress. Take advantage of free printable budget templates available online to get started on your financial journey today.