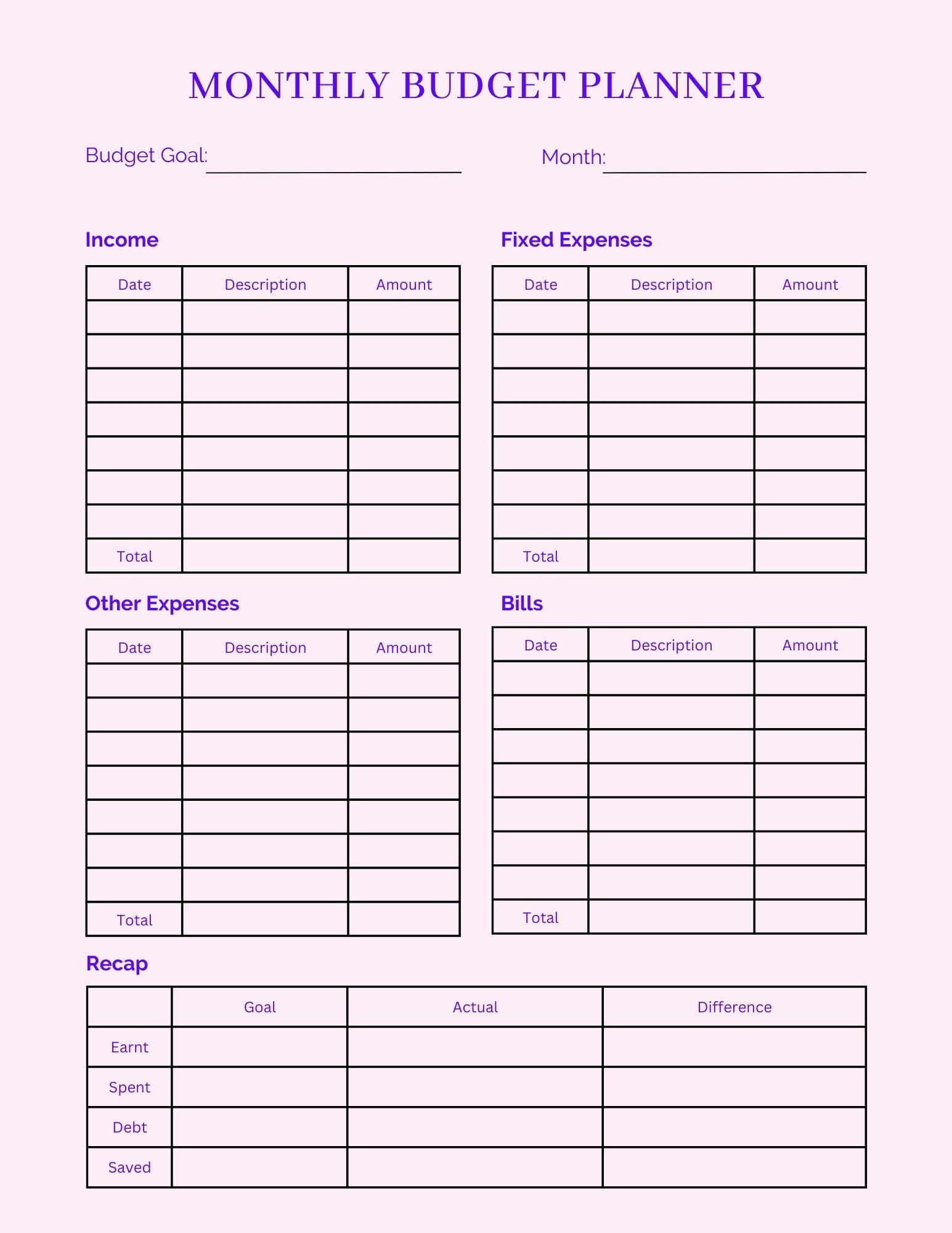

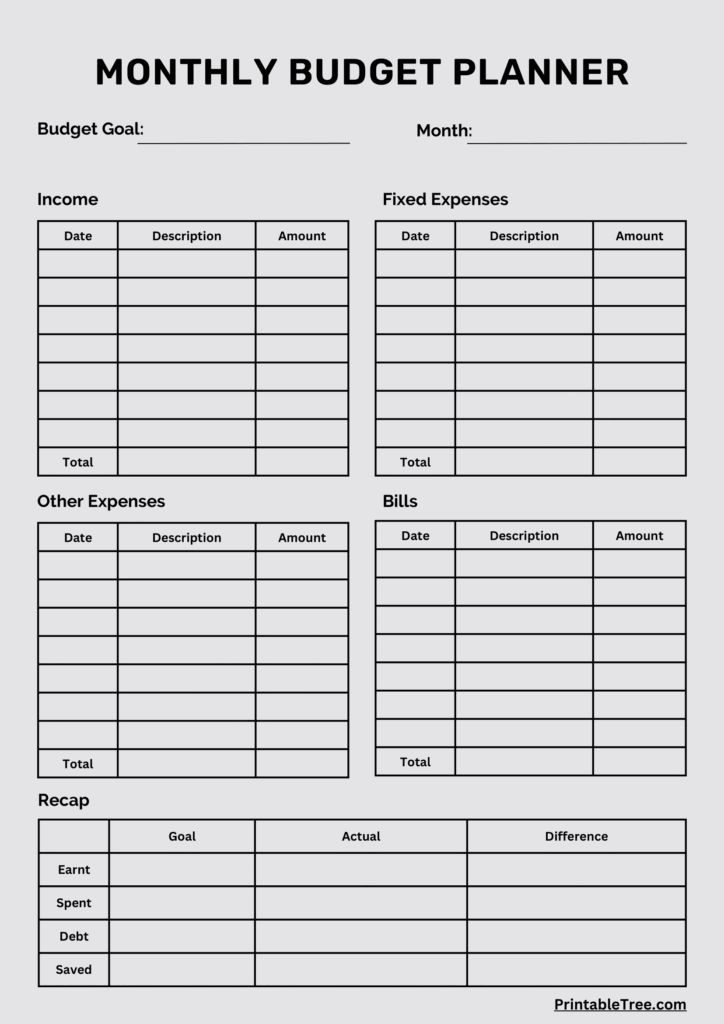

A monthly printable budget planner is a valuable tool for managing your finances effectively. By tracking your income and expenses each month, you can gain a clear understanding of where your money is going and make informed decisions about your spending habits. With a printable budget planner, you can set financial goals, track your progress, and make adjustments as needed.

Additionally, using a monthly budget planner can help you avoid overspending, save money for future expenses or emergencies, and reduce financial stress. By planning ahead and sticking to a budget, you can take control of your finances and work towards achieving your financial goals.

How to Use a Monthly Printable Budget Planner

Using a monthly printable budget planner is simple and effective. Start by gathering information about your income, including your salary, bonuses, and any other sources of income. Next, list all of your expenses, including fixed expenses like rent and utilities, as well as variable expenses like groceries and entertainment.

Once you have a clear picture of your income and expenses, use the printable budget planner to allocate funds for each category, such as housing, transportation, and savings. As the month progresses, track your spending and adjust your budget as needed to stay on track. At the end of the month, review your budget planner to see how well you stuck to your budget and identify areas for improvement.

Conclusion

A monthly printable budget planner is a valuable tool for managing your finances and achieving your financial goals. By tracking your income and expenses, setting a budget, and making adjustments as needed, you can take control of your finances and work towards a more secure financial future. Start using a monthly printable budget planner today and see the positive impact it can have on your financial well-being.