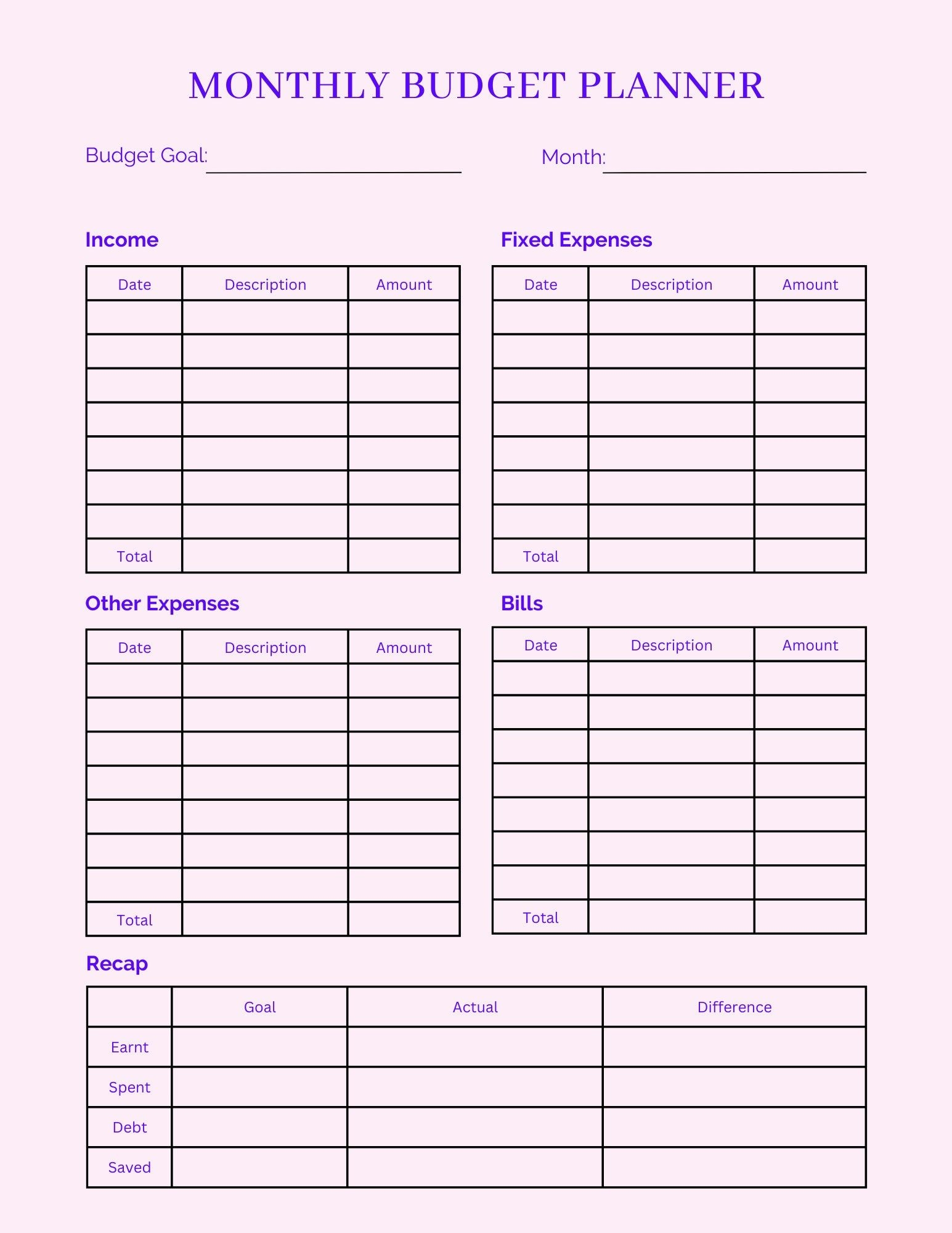

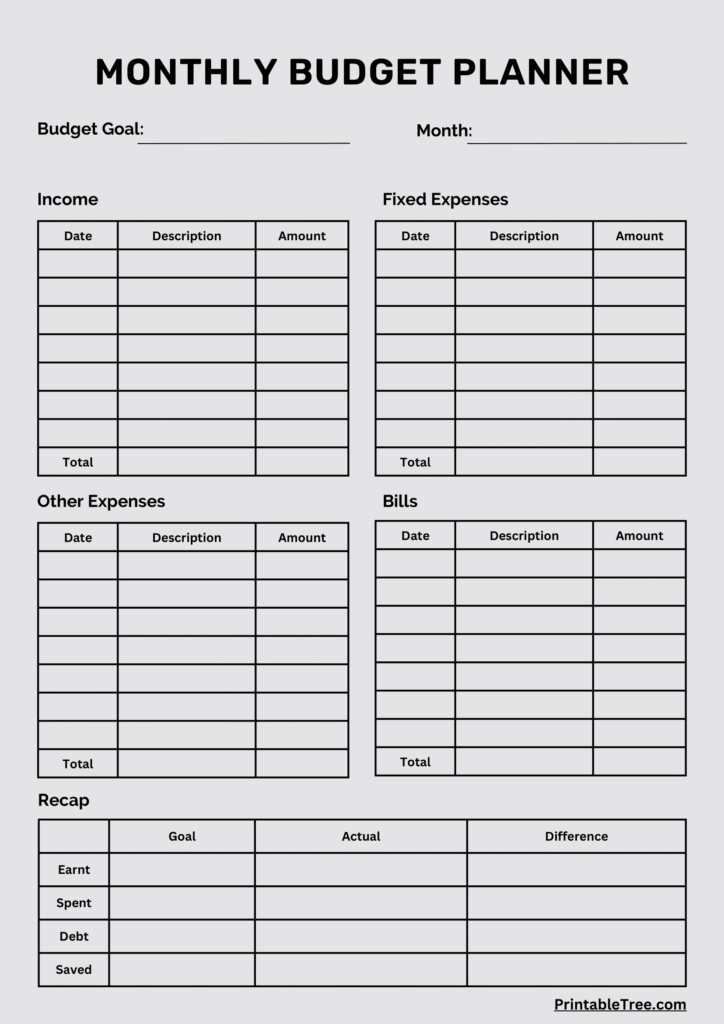

A printable budget planner is a handy tool that helps you keep track of your finances and manage your money effectively. It typically includes sections for income, expenses, savings, and debt, allowing you to set financial goals and track your progress towards them. By using a printable budget planner, you can gain better control over your finances and make informed decisions about your spending habits.

Using a printable budget planner is easy and can be a game-changer for your financial well-being. Start by filling in your income sources, such as salary, bonuses, and side hustles. Next, list all your expenses, including rent, utilities, groceries, entertainment, and any other regular payments. Once you have a clear picture of your income and expenses, you can allocate funds to different categories, set savings goals, and track your progress over time. Regularly updating your budget planner and reviewing your financial situation can help you stay on top of your finances and make adjustments as needed.

Benefits of Using a Printable Budget Planner

There are several benefits to using a printable budget planner. Firstly, it can help you identify areas where you are overspending and make necessary adjustments to stay within your budget. Secondly, it can help you track your progress towards financial goals, such as saving for a vacation or paying off debt. Additionally, a budget planner can help you plan for unexpected expenses and build an emergency fund. By using a printable budget planner, you can take control of your finances and work towards a more secure financial future.