A budget planner is a valuable tool that helps individuals or families manage their finances effectively. By creating a budget, you can track your income and expenses, set financial goals, and make informed decisions about your money. Having a budget planner can also help you identify areas where you can cut back on spending and save more money for the future.

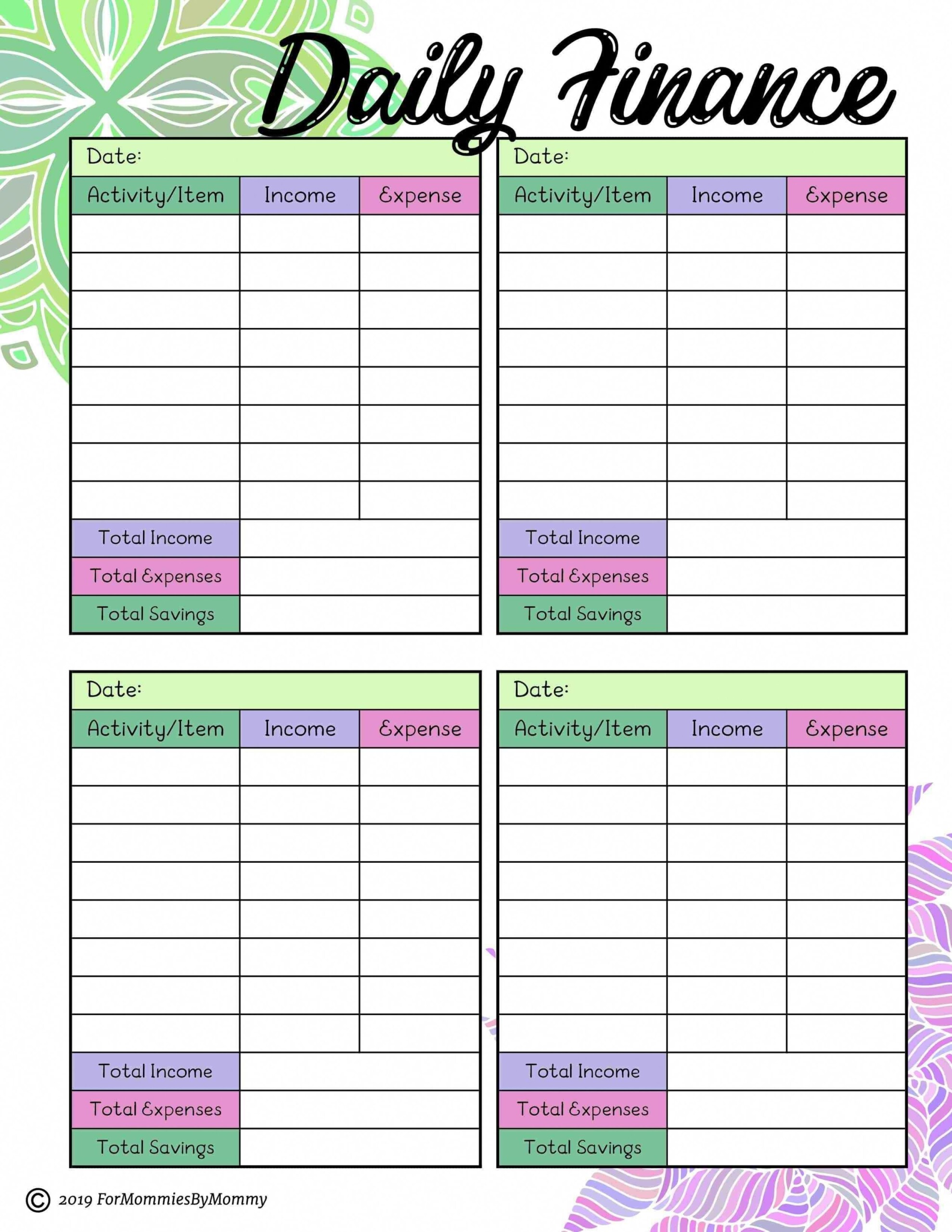

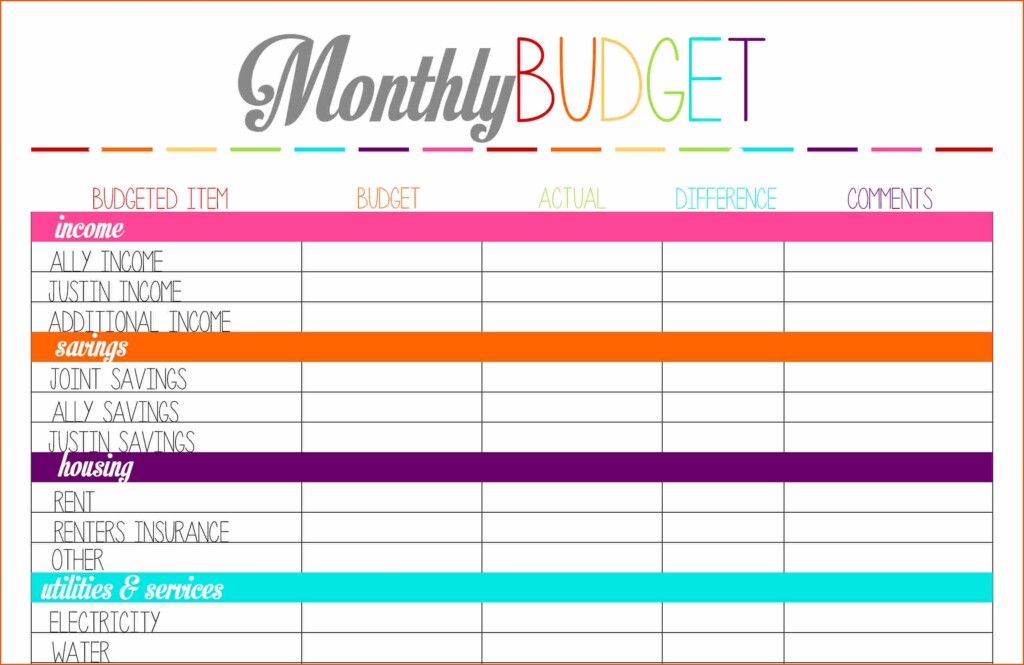

With a printable budget planner template, you can easily organize your finances and stay on top of your budgeting goals. These templates typically include sections for income, expenses, savings, and debt payments, making it simple to track your financial progress and make adjustments as needed.

How to Use a Printable Budget Planner Template

Using a printable budget planner template is straightforward and can be customized to fit your specific financial situation. Start by listing all sources of income, including wages, bonuses, and any other money coming in each month. Then, detail all monthly expenses, such as rent, groceries, utilities, and entertainment.

Once you have your income and expenses listed, subtract your total expenses from your total income to determine your net income. From there, you can allocate funds to different categories, such as savings or debt repayment. Regularly update your budget planner to reflect any changes in your financial situation and stay on track with your financial goals.

Where to Find Printable Budget Planner Templates

There are many resources online where you can find printable budget planner templates for free. Websites like Pinterest, Etsy, and Microsoft Office offer a variety of templates that you can download and print at home. You can also create your own custom budget planner using spreadsheet software like Microsoft Excel or Google Sheets.

By using a printable budget planner template, you can take control of your finances and work towards a more secure financial future. Start budgeting today and see the positive impact it can have on your financial well-being.