Managing your finances can be overwhelming, but with a budget planner, you can take control of your money and achieve your financial goals. A budget planner helps you track your income, expenses, and savings in an organized manner. It allows you to see where your money is going and make informed decisions about your spending habits. By using a budget planner, you can avoid overspending, save for emergencies, and plan for the future.

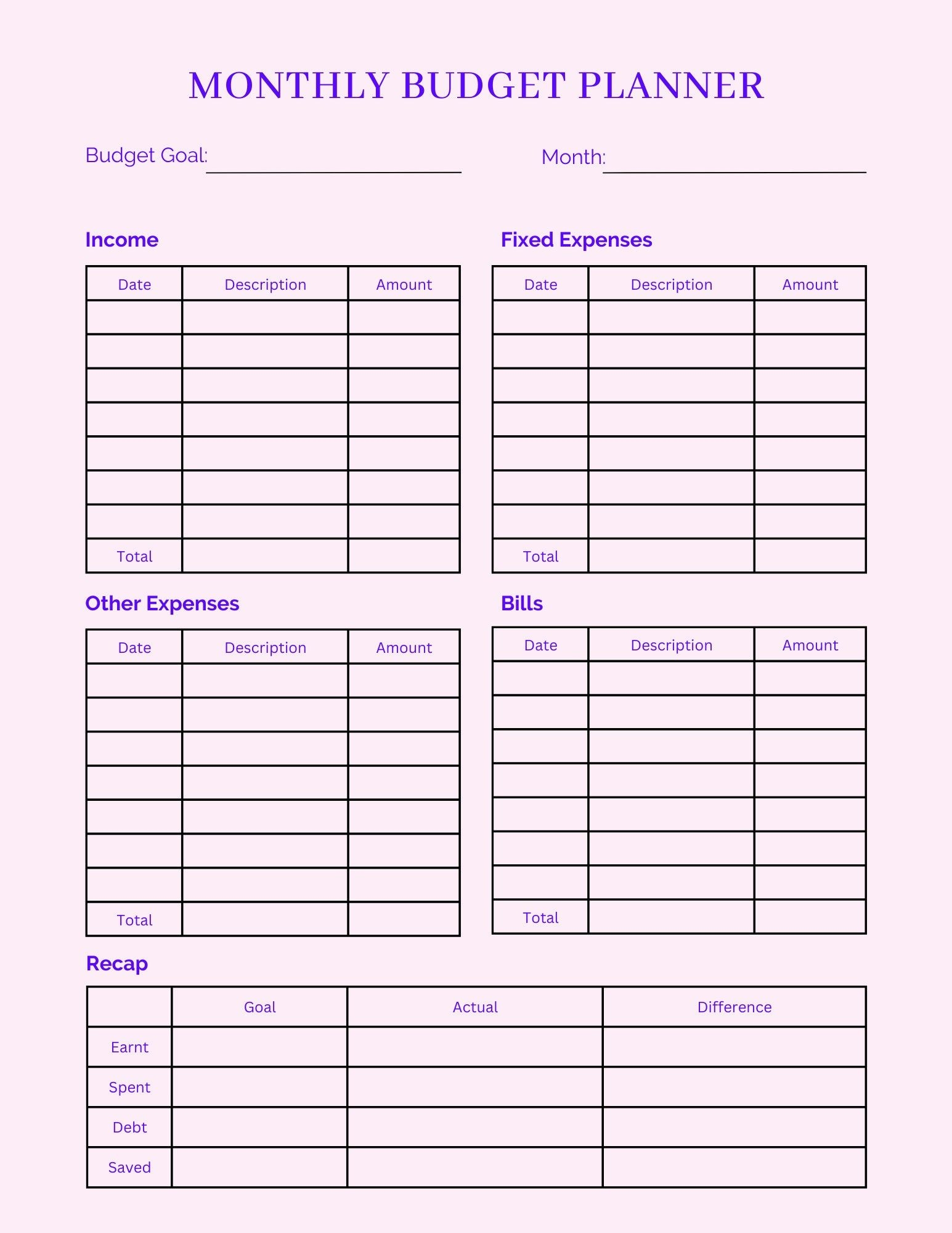

A printable free budget planner is a convenient tool that allows you to track your finances on paper. To use a printable budget planner effectively, start by listing all your sources of income and fixed expenses, such as rent, utilities, and loan payments. Then, track your variable expenses, like groceries, entertainment, and shopping. Allocate a portion of your income to savings and investments. Review your budget regularly to ensure that you are staying on track and making adjustments as needed. By using a printable free budget planner, you can achieve financial stability and peace of mind.

Conclusion

Having a budget planner is essential for managing your finances effectively. With a printable free budget planner, you can easily track your income, expenses, and savings. By using this tool, you can make informed decisions about your money and work towards achieving your financial goals. Start using a printable free budget planner today and take control of your finances.